| Michelle “Shelly” R. Swanback, 55, serves as President of the Company and chief executive officer of TTEC Engage. She joined the Company in May 2022 as the chief executive officer of TTEC Engage and was named President for TTEC Holdings, Inc. in November 2022. With a proven track record driving growth in the digital environment, Shelly is both a market maker and a strong cultural leader with over 30 years of experience in digital transformation, strategic consulting, technology, services, analytics and M&A. Prior to TTEC, between 2020 and 2022, Ms. Swanback was President of Product and Platform at Western Union (NYSE:WU), where she led the company’s digital transformation and doubled the WU digital business to $1 billion. Between 2014 and 2020, Ms. Swanback led Accenture Digital, building it into a global transformation powerhouse with more than $20 billion in annual revenue. Shelly is currently a board member for Willis Towers Watson (NASDAQ:WTW). Ms. Swanback holds bachelor’s degrees in Finance and Computer Information Systems from Colorado State University.

| Francois Bourret | Martin F. DeGhetto, 57, serves44, joined TTEC in 2016 as TeleTech’s Executive Vice President, Customer Management Services, TeleTech’s largest business segment.part of an acquisition and has been serving as Chief Accounting Officer since 2023. In April 2023, Mr. DeGhetto joined TeleTech as Executive Vice President of Operations in 2010 andBourret assumed the responsibilities of the interim Chief Financial Officer for TeleTech’s information technologythe Company, the role that he maintained until February 29, 2024.

Mr. Bourret brings over 20 years of financial experience with public companies and private equity owned businesses to the role. Since joining TTEC, Mr. Bourret served in 2012. Between 2008various significant roles in the TTEC finance and 2010, Mr. DeGhetto was an executive vice presidentaccounting organization, including chief financial officer for the TTEC Engage business segment between 2018 and chief operations officer commercial division at Connextions, Inc., a privately-held technology2022, as the Company’s global controller since June 2002, and business services company for healthcare industry.his appointment as the Chief Accounting Officer in 2023. Prior to Connextions,TTEC, Mr. DeGhetto spent almost a decade at Convergys Corporation (NYSE:CVG), a customer management company, where he held various positions of increasing responsibility culminating in his role as a senior vice president, North American/European operations which he held between 2003 and 2008. Prior to Convergys, Mr. DeGhetto was an executive with American Express Company and AT&T/American Transtech. Mr. DeGhetto holds a B.S. Professional Management degree from NOVA Southeastern University. |

|

|

|

|

| Judi A. Hand, 54, serves as TeleTech’s Executive Vice President, Customer Growth Services. She joined TeleTech in 2007 as President and General Manager for Direct Alliance Corporation, a TeleTech wholly owned subsidiary, and between 2011 and 2013Bourret served as TeleTech’s Chief Sales Officer. Between 2003the chief financial officer and 2007, Ms. Hand was a senior executive with AT&T (NYSE:ATT), culminating her career there as a senior vice president for enterprise sales. Prior to AT&T, Ms. Hand worked at Qwest, a public global communications company and several of its subsidiaries in sales and marketing roles of increasing responsibility. Ms. Hand is a member of the board of directors of Manitoba Telecom Services, Inc.Atelka, a Canadian customer care outsourcing company; and worked for Kilmer Capital Partners, a private equity fund; and for KPMG.

Mr. Bourret holds a Master of Business Administration degree from Université Laval in Québec, Canada; and is a Chartered Financial Analyst (CFA). |

| David J. Seybold, 58, joined TTEC in December 2022 as the chief executive officer for TTEC Digital. An experienced, global business leader with a Canada corporation. Ms. Handpassion for technology, Mr. Seybold’s career is characterized by driving growth through digital transformation at scale. Prior to joining TTEC, Mr. Seybold, was chief executive officer, Americas for Atos SE, a Euronext-listed technology transformation company. Between 2015 and 2021, he served as the president, North America and chief operating officer for Avanade (a Microsoft – Accenture joint venture); and prior to that, Mr. Seybold spent more than 26 years in various senior executive roles for IBM (IBM:NYSE). Mr. Seybold holds a bachelor’s degree in Quantitative Business Analysis and a degree in Economics from Penn State University; a master’s of science degree in Operations Management and an MBA from Stanford University and a B.S. in Communications degree from University of Nebraska. |

|

|

|

|

| Charles “Keith” Gallacher, 48, serves as Executive Vice President Global Markets and Industries. He joined TeleTech in 2013. Between 2007 and 2013, Mr. Gallacher was a partner and managing director for Accenture plc (NYSE:ACN), where he led the North American technology specialized sales teams. Between 2003 and 2006, Mr. Gallacher worked for Cognizant as vice president for North American sales and business development. Between 1997 and 2003, Mr. Gallacher was a partner and managing director for CSC Consulting (Computer Sciences Corp). Mr. Gallacher started his career in technology at EDS (now HP). He holds a B.B.A. in Business from the University of Texas at Arlington.Maryland, Robert H. Smith School of Business.

|  |

|

|

|

| Regina M. Paolillo, 57, serves as Executive Vice President, Chief Administrative and Financial Officer. Ms. Paolillo joined TeleTech in 2011. Between 2009 and 2011, Ms. Paolillo was an executive vice president for enterprise services and chief financial officer at Trizetto Group, Inc., a privately held business and professional services company serving the healthcare industry. Between 2007 and 2008, Ms. Paolillo served as a senior vice president, operations group for General Atlantic, a leading global growth equity firm with U.S. $17 billion in capital. Between 2005 and 2007, Ms. Paolillo served as an executive vice president for revenue cycle and mortgage services at Creditek, a Genpact subsidiary, (NYSE:G) a global business process and technology management company. Prior to the Company’s acquisition by Genpact, between 2003 and 2005 and 2002 and 2003, Ms. Paolillo was Creditek’s chief executive officer and chief financial officer respectively. Prior to Creditek, Ms. Paolillo served as the chief financial officer and executive vice president for corporate services at Gartner, Inc., (NYSE:IT) an information technology research and advisory company. Ms. Paolillo holds a B.S. in Accounting degree from New Haven University.

| |

|

|

|

| Margaret B. McLean, 52,60, serves as Senior Vice President, General Counsel and Chief Risk Officer.Officer of TTEC. She joined TeleTechTTEC in June 2013. Between 1998 and 2013, Prior to TTEC, Ms. McLean was a senior executive atthe chief legal and risk officer for CH2M HILL,(now part of Jacobs Engineering Group (NYSE:JEC)), a global engineering and program management company, serving as the Company’s Chief Legal Officer starting in 2007.company. Prior to CH2M, Ms. McLean was a corporate finance and M&A partner at thea major law firm, of Holme Roberts and Owen (now Bryan Cave), working in its Denver, London, and Moscow offices. Ms. McLean started her career in IT at Hewlett Packard (NYSE:HPQ)HPE) and led the application systems department for Science Applications Int’l (NYSE:SAIC). She holds a JD from the University of Michigan, an MBA from the University of Colorado, and a B.S.bachelor’s degree in Management Information Systems and Computer Science from the University of Arizona. |

18

Table of Contents

|

| Robert N. Jimenez, 44, serves as TeleTech’s Executive Vice President, Customer Strategic Services. From 2012 to 2015 Mr. Jimenez was the global vice president, customer services at Genpact (NYSE:G). Between 2011 and 2012, Mr. Jimenez served as managing partner, CIO Advisory of Tatum Consulting; and between 2009 and 2011 Mr. Jimenez served as the North American customer experience partner for EMC Consulting. From 2004 to 2009, Mr. Jimenez was vice president, FS consulting leader of Capgemini Consulting; and from 1999 to 2004 Mr. Jimenez was an associate partner, financial services at IBM Global Business Services. He holds a B.A. in Economics and International Relations from Brown University.

|  | Kenneth “Kenny” R. Wagers, |

|

|

| Steven C. Pollema, 56, serves as52, joined TTEC in February 2024 and assumed responsibilities of the executive in charge of our Customer Technology Services business segment. Mr. Pollema joined TeleTech in 2011 as part of eLoyalty acquisition, where he worked since 2001 and held various senior executive roles including theCompany’s Chief Financial Officer as of March 1, 2024.

Mr. Wagers brings to the role over 28 years of financial and SVP, Global Deliveryoperational experience with public and Operations. private companies. Prior to eLoyalty,joining TTEC, Mr. Pollema wasWagers served as chief financial officer of Flexport, a global logistics and freight forwarding business from 2021 to 2023; as chief financial officer of FleetPride, a retailer of parts for heavy-duty trucks and trailers, between 2019 and 2021; and as chief operating officer of XPO Logistics, a global provider of supply chain solutions, between 2018 and 2019. In 2020, Mr. Wagers joined the Presidentboard of MarchFirst (fka Whittman-Hart). directors of Snap One Holdings Corporation (NASDAQ:SNPO), where he currently serves on the Audit and Risk Management committee, which he chaired between 2020 and 2022. Mr. Pollema began his professional career at Accenture within the Financial Services/Technology practice. Mr. PollemaWagers holds a BA in Finance and an MBA in Management Information Systems and a B.S. in Finance from the University of Iowa.Georgia State University. |

Information regarding Kenneth D. Tuchman, Chairman and CEO, and James E. Barlett, Vice Chairman,Chief Executive Officer, is provided in this section under the heading “20162024 Director Nominees.Nominees.”

Compensation Discussion and Analysis29

COMPENSATION DISCUSSION AND ANALYSIS In this section, we discuss our compensation philosophy and describe the 20152023 compensation program for our Chief Executive Officer, former Chief Financial Officer, interim Chief Financial Officer and three additional highest compensated members of our executive leadership team, whom we refer to as our named executive officers (“NEOs”)Named Executive Officers (NEOs). We describe compensation earned by each of our named executive officersNamed Executive Officers and explain how our Compensation Committee of the Board determined this compensation, including its rationale for specific 20152023 compensation decisions. 2015 TeleTech2023 Performance Highlights

In 2015, we had the followingOur 2023 performance highlights:is summarized below:

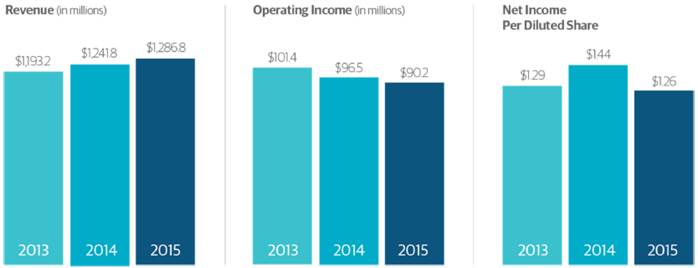

| ·

● | Our revenue was $1.29$2.46 billion, an increase of 3.6 percent over the year ago period. On a non-GAAP constant currency basis2, our 2015 revenue grew 8.8 percent to $1.35 billion0.8% over the prior year.·Income

|

| ● | Our income from operations was $90.2$118.0 million, or 7 percent4.8% of revenue, a 6.5 percent30.0% decrease year over year. Income from operations on a non-GAAP constant currency basis2,1 was $115.0$200.4 million, or 8.5 percent8.1% of adjusted revenue, compared to 8.1 percent10.2% in the prior year.·

|

| ● | Our net cash provided by operating activities increased to $133.8was $144.8 million compared to $94.1$137.0 million in the prior year. |

| ● | | ·We booked $470 million in new business, a 7 percent increase over the prior year. The bookings mix was diversified across all business verticals with approximately 80 percent from existing clients, 56 percent from our emerging businesses, and 15 percent outside of the United States.

·Our diluted earnings per share were $1.26$0.18 compared to $1.44$2.18 in the prior year, and $1.48$2.181 compared to $1.43$3.59 in the prior year on a non-GAAP basis2.

·basis.

|

| ● | We initiated a semi-annual cash dividend of $0.18 per share totaling $17.4 million for the year.·We repurchased 686 thousand shares forpaid a total cost of $17.2 million.

$49.2 million in cash dividends to our shareholders. |

2 TeleTech computes company performance metrics on a constant currency basis in order to compare year-over-year operating performance. To establish a constant currency comparison, actual reported metrics are translated utilizing each underlying exchange rate in effect at the end of the prior year resulting in year-over-year operating performance excluding the impact from currency fluctuations. Additionally, the Company adjusts for non-operating items including, but not limited to, asset impairment and restructuring charges, deconsolidation of subsidiaries, changes in acquisition earn-outs and changes in tax valuation allowances and return to provision adjustments. The same methodology is utilized for other adjusted and non-GAAP constant currency metrics reported in this Proxy Statement. Please review a copy of the 2015 Annual Report and 2015 full year earnings press release for a reconciliation of these non-GAAP adjustments.

| 1. | TTEC presents company performance metrics on a non-GAAP basis to more accurately convey the performance of the business, which adjusts for non-operating items including, but not limited to, asset impairment, restructuring charges, cybersecurity incident-related costs, equity-based compensation expense, depreciation and amortization expense, changes in acquisition contingent consideration, changes in tax valuation allowances, return to provision adjustments, and one-time non-recurring items. For additional information, please review GAAP to Non-GAAP Reconciliation of Performance Metrics on page 59 of this Proxy Statement. |

2015

Named Executive Officers | ·

● | Kenneth D. Tuchman, Chairman of the Board and Chief Executive Officer | ·Judi A. Hand, Executive Vice President, Customer Growth Services

| ·Martin F. DeGhetto, Executive Vice President, Customer Management Services

·Charles “Keith” Gallacher, Executive Vice President, Global Markets and Industries

| ·Regina M. Paolillo, Executive Vice President, Chief Administrative and Financial Officer.

|

| ● | Michelle “Shelly” R. Swanback, President, TTEC Holdings, Inc. and chief executive officer, TTEC Engage |

| ● | Francois Bourret, Chief Accounting Officer and Interim Chief Financial Officer |

| ● | Dustin J. Semach, Former Chief Financial Officer |

| ● | David J. Seybold, chief executive officer, TTEC Digital |

| ● | Margaret B. McLean, General Counsel and Chief Risk Officer

|

19

2015

2023 Executive Compensation Summary Our executive compensation program is designed to reward financial results and effective strategic leadership, which we believe are key elements in building sustainable value for stockholders. Our compensation program’sprogram performance metrics align the interests of our stockholders and senior executives by correlating the timing and amount of actual pay to the Company’s short-short-term and long-term performance goals. Our compensation program encouragesprograms encourage ethical and responsible conduct in pursuit of these goals and the alignment of our leaders with TeleTech’sTTEC’s vision, mission, and values. We carefully benchmark our compensation decisions against a relevant group of peer companies, – all of which are our potential competitors, for the caliber of executive talent required to manage a global and complex business like TeleTech.TTEC. Our executive compensation program includesprograms include three principleprincipal elements: Compensation Element | Purpose | ·Base Salary

| ·Provides competitive fixed dollar compensation aligned to the median of our peer group.

compensation. | | | ·Annual Performance-Based Cash Incentive Awards

| ·Provides “at risk” annual variable cash consideration that aligns executive compensation to the Company and individual achievementsachievement of short-term (annual) performance objectives, as established by the Board of Directors. This short-term variable cash compensation element is targeted at the 75th percentile of our peer group.

| | | ·Annual Equity Grants

| ·Provides an “at risk” long-term variableperformance-based and time-based equity compensation opportunity. Awarded annually, thisOur annual equity incentive compensation is based onprogram includes two components: one that rewards the individual’sprior year’s performance and the Company’s performance in the year granted, but links directly to the Company’s performancevests over time, asand another that is forward looking and rewards growth of key performance indicators like Revenue and Adjusted EBITDA three years into the future. From time-to-time we may grant equity vests. This long-term variable compensation element is targeted at the 75th percentileawards that are not part of our peer group.

annual program, such as upon the promotion of an executive (which we refer to as “promotional grants”) or to encourage retention (which we refer to as “retention grants”). By emphasizing a longer-term view and long-term growth objectives with equity performance incentives, the Company aligns our Executive Officers’ interests with the interests of and value creation for our stockholders. |

In 2015,2023, we paid the following Total Direct Compensation to our Named Executive Officers: Named Executive Officers | Actual Total Direct

(TDC) Compensation | Market TDC at 25th | Market TDC at 50th | Market TDC at 75th | Percentile | Kenneth D. Tuchman | $ 11 | $ 3,281,100 | $ 4,431,000 | $ 6,042,000 | <25th | Martin F. DeGhetto | $1,386,893 | $ 1,111,000 | $ 1,373,000 | $ 1,957,000 | 50th | Charles "Keith" Gallacher | $1,647,899 | $ 1,042,000 | $ 1,302,000 | $ 1,740,000 | 70th | Judi A. Hand | $1,438,470 | $ 1,058,000 | $ 1,308,000 | $ 1,864,000 | 55th | Regina M. Paolillo | $1,382,085 | $ 1,539,000 | $ 1,970,000 | $ 2,265,000 | <25th |

| Named Executive Officers | Actual Total Direct

(TDC) Compensation 1 | Market TDC at 25th | Market TDC at 50th | Market TDC at 75th | Percentile | | Kenneth D. Tuchman 2 | $1 | $5,850,000 | $7,208,000 | $9,370,000 | <25th | | Michelle “Shelly” R. Swanback 3 | $5,947,110 | $1,937,000 | $2,984,000 | $4,363,000 | >75th | | Francois Bourret 4 | $917,947 | $382,932 | $505,880 | $811,451 | >75th | | Dustin J. Semach 5 | $159,615 | $2,148,000 | $2,735,000 | $3,327,000 | - | | David J. Seybold | $937,507 | $934,000 | $1,912,000 | $3,350,000 | <50th | | Margaret B. McLean | $686,536 | $746,000 | $1,235,000 | $1,643,000 | <25th |

1As previously disclosed, at Mr. Tuchman’s request, the Compensation Committee approved Mr. Tuchman’s base salary to be $1 per year.

| 1. | Actual TDC represents base salary earned in 2023, bonus paid in 2023 for 2022 performance, retention bonuses paid in 2023, fair market value (FMV) of RSU equity grants awarded in 2023, and fair market value (FMV) of performance-based grants, at target achievement, awarded under the 2023 annual long-term incentive plan. |

| 2. | As previously disclosed, at Mr. Tuchman’s request, the Compensation Committee approved Mr. Tuchman’s base salary to be $1 per year. |

| 3. | Ms. Swanback’s actual TDC includes a one-time $2 million RSU equity grant, vesting in equal installments over a five-year period and a $2 million performance-based equity grant, subject to a 3-year cliff vesting period, both issued in connection with her promotion to President, TTEC Holdings, Inc. |

| 4. | The market data presented for Mr. Bourret corresponds with his primary role as Chief Accounting Officer. |

| 5. | Due to Mr. Semach’s limited tenure during 2023, we have not compared his 2023 actual TDC against the market benchmarks. |

The mix of base and variable “at risk”,“at risk” compensation for 20152023 was as follows:follows and excludes our CEO, since he does not participate in TTEC’s incentive programs:

20

Table of Contents

CONSIDERATION OF LAST YEAR’S “SAY-ON-PAY” VOTE At our 20152023 Annual Meeting of Stockholders, 99.79 percent99% of the votes cast in our stockholder advisory vote (our “say-on-pay” vote) approved the compensation of our named executive officers.Named Executive Officers (our “Say-On-Pay” vote). In light of this strong stockholder support, the Compensation Committee of the Board made no significant changes to the overall design of our compensation programs during 2015. They did, however, makebut continued its pay-for-performance philosophy by putting a modification to the distributionsubstantial portion of the funded incentive pool; allocating more dollars based on segment performance, furtherexecutives compensation at risk and aligning bonuses to personal performance. The Compensation Committee will continue to consider the outcome of the Company’s say-on-pay votes when making future compensation decisionsexecutive officers’ interests with value generation for our named executive officers.TTEC stockholders. The Compensation Committee considered, andof the Board will continue to consider, refinements and supplements to the currentreview best practices in executive compensation and adjust the structure of TTEC executive compensation to stay current on compensationbe consistent with market trends, our pay-for-performance philosophy, and to make sure that TeleTech’sTTEC’s executive compensation aligns the interest of the executive leadership team with the interests of the Company’s stockholders. Stockholders will again consider our executive compensation on an advisory basis as part of the 2026 Annual Stockholder Meeting, and the Compensation Committee of the Board will continue to take into account this input when making future compensation decisions for our Named Executive Officers.

CONSIDERATION OF “FREQUENCY ON SAY-ON-PAY” VOTE At our 2023 Annual Meeting of Stockholders, we asked stockholders to consider how often they wish to vote, on an advisory basis, on Say-On-Pay matters (the “Frequency of Say-On-Pay” vote). Stockholders indicated strong support of our existing practice, with 71% voting in favor of an advisory, non-binding vote on executive compensation every three years. In the two previous stockholder votes, occurring at the 2020 and 2017 Annual Meetings of Stockholders, TTEC stockholders approved the Company’s executive compensation by 99% or higher. The stockholders will next consider how often they wish to vote on “Say-On-Pay” matters involving executive compensation as part of the 2029 Annual Meeting of Stockholders. EXECUTIVE LEADERSHIP TEAM COMPENSATION APPROACH AND STRUCTURE Our Approach to Executive Leadership Compensation We structure our executive compensation to attract and retain executive talent who can maximize our performance results. Our compensation program is designed to motivate our executive leadership team to remain focused on delivering superior performance that creates long-term investor value. Our executive compensation program also places significant weight on how our leaders align their conduct with TeleTech’sTTEC’s vision, mission, and values as they achieve their personal goals and the Company’s performance goals. Our Compensation Practices Include:

| Pay for Performance. We encourage a results-oriented culture through pay-for-performance compensation, and annually review executive compensation against Companythe Company’s overall performance and its annual goals. |

| Competitive Compensation Targets. We The Compensation Committee of the Board annually sets each executive’s target executive basetotal direct compensation at the medianbased on a review of our peer group, and the “at risk” variable compensation opportunities at 75th percentile of compensation offered by our competitors. market benchmarks. | | Rigorous Performance Metrics. The Compensation Committee of the Board annually reviews and re-sets executive performance targets to assure that they appropriately reflect the goals of the business and are challenging, but achievable. | | Stockholder Alignment. Through our compensation practices, we align the interests of our namedNamed Executive Officers, other executive officers, and our stockholders to maximize long-term performance goals of the Company. |

| Affordability of Rewards. We ensure that our rewards are affordable by aligning them to the Company’s results of operation as they compare to our annual business plan. | | Significant “at risk” Component. We structure our compensation programs with a significant portion of variable or “at risk” component to ensurepay so that the actual compensation realized by named executive officersNamed Executive Officers directly and demonstrably links to individual and companywideCompany-wide performance. | | Share Ownership Guidelines. OurTTEC’s Chief Executive Officer and Chief Financial Officerthe chief executive officers of TTEC’s business segments are expected to hold TeleTechTTEC equity in an amount of at least 4 times their base compensation; our Chief Financial Officer is expected to hold TTEC equity in the amount of at least 3 times theirhis base compensation; while other members of the executive leadership team including all NEOs, are expected to hold equity equal to 1 to 2.5 times their base compensation. compensation based on their position level. |

| Restrictive Covenants. Members of our executive leadership team are subject to market appropriate restrictive covenants, effective on separation from TeleTech.TTEC. These restrictive covenants include non-competition, client and employee non-solicitation, and customary non-disclosure obligations. | | Individual Accountability. Our compensation program is designed to ensure thatincentivize our named executive officersNamed Executive Officers to remain focused on individual operationalour company and their group financial goals to build the foundation for our long-term success. | | Review of Compensation Peer Group. Our The Compensation Committee of the Board reviews our executive compensation program against our peer group annually and adjusts, when necessary, to make sure that it remains relevant and appropriate as a comparison for our executive compensation program. | | appropriate. |

21

Executive Leadership Team Compensation Structure

EXECUTIVE LEADERSHIP TEAM COMPENSATION STRUCTURE To achieve its overarching objectives, our executive compensation program consists of the following three principleprincipal elements: Compensation

Element | Characteristics | Purpose | Philosophy | | | | | Base salary | Fixed annual compensation that provides a competitive level of base compensation. | Compensate senior executives for their level of experience and responsibility. | We believe base salary should be competitive, and we target it at the 50th percentile of our peer group. competitive. | Annual performance-based cash incentive awards | Variable annual cash compensation opportunity funded based on objective Company performance targets (revenue and operating income) and paid based on subjective measures of individual performance. | Motivate and reward senior executiveexecutives for performance against short-term Company goals. | We believe in providing appropriate incentiveincentives to drive the Company’s short-term financial and operational objectives. This incentive opportunity is targeted at the 75th percentile of our peer group. | Equity awards | Variable equity compensation granted annually, usually, in the form of restricted stock units (RSUs), or stock options. Whileperformance-based award opportunities as deemed appropriate. Our annual equity incentive program includes two components: one that rewards the awards are based on the individualprior year’s performance and the Company’s performance in the year granted, the incentive links directly to the Company’s performancebut vests over time, asand another that is forward looking and rewards growth of key performance indicators like Revenue and Adjusted EBITDA over a three-year period. By emphasizing a longer-term view in equity vests.performance incentives, the Company aligns our Executive Officers’ interests with the interests of and value creation for our stockholders. | Motivate and retain senior executives during the multi-year vesting periodand target periods and focus them on longer termlonger-term performance objectives by aligning their interests with those of our stockholders through the vesting period. | We believe that annual equity grants that vest over multiple years encourage the executive management team to focus on the long-term stock value appreciation. The incentive provides We also believe that multi-year performance targets offer important alignment between stockholders’ and executives’ interests over the long term. These incentives in the aggregate provide a market competitivemarket-competitive equity grant targeted at 75th percentile of our peer group.opportunity. | | | | | |

In addition to these primary components of compensation, our senior executives are also eligible to participate in our general health and welfarewellness programs, 401(k) plan, life insurance program, and other employee benefit programs. Although to be competitive, we pay as perquisites all or a portion of certain named executive officers’ healthcare premiums, weWe believe that perquisites should be limited in scope and value, and, historically, they have not constituted a significant portion of executive compensation.

OVERSIGHT OF OUR EXECUTIVE COMPENSATION PROGRAM Role of the Compensation Committee of the Board Our Compensation Committee of the Board determines all compensation for members of our executive leadership team, including our named executive officers,Named Executive Officers, on an annual basis. In doing so, the Compensation Committee:Committee of the Board: | ·

● | Evaluates the compensation received during the year by each executive and considers the Company’s performance, the individual performance of each executive and his/her skills, experience, and responsibilities to determine if any change in the executive’s compensation is appropriate. ·

|

| ● | Reviews with the Chief Executive Officer the performance of the other named executive officers.·Named Executive Officers.

|

| ● | Reviews peer group data and the advice of the compensation consultant as a measure of the competitive market for executive talent in our industry. ·

|

| ● | Considers the executive’s contribution to the Company’s overall operating effectiveness, strategic success, and profitability, and considers the quality of the executive’s decision-making. |

| ● | ·Considers the executive’s role in developing and maintaining key client relationships.

·

|

| ● | Considers the Company’s financial results for the year and how the executive contributed to these results but does not adhere to strict formulas to determine the mix of base salary, equity grants and cash incentives. ·

|

| ● | Evaluates the level of responsibility, scope, and complexity of sucheach executive’s position relative to other Company executives.·

|

| ● | Determines the composition and amount of compensation for each named executive officerNamed Executive Officer and uses its subjective judgment in determining the amount of each compensation element in order to retain and motivate current executives.·

|

| ● | Assesses the executive’s leadership growth and management development over the past year. |

The Compensation Committee of the Board utilizes these subjective factors because it believes they are critical to increasing stockholder value. These factors are not quantified or weighted for importance;importance, and the Compensation Committee’sCommittee of the Board’s use of these factors is tied directly to the individual role and the responsibilities of each executive officer. For example, greater weight may be given to the role of developing and maintaining key client relationships for the Executive Vice President, Global Markets and Industries due to his responsibilities for overseeing sales operations, while greater weight will be given to contribution to our overall operating effectiveness, strategic success and profitability, and completion of strategic projects, among other factors, for the Chief Financial Officer, given her responsibilities relating to our financial performance and growth. 22

Table of Contents

Funding for performance-based cash incentives and our equity grants areis based on objective Company performance targets set at the beginning of each year. As a result, there is uncertainty with respect to the achievement of these funding targets at the time they are set. The Compensation Committee of the Board has the authority to modify the funding for these variable incentives, in its sole discretion, when material changes in the business warrant it. Our ability to achieve the funding target is heavily dependent not only on factors within our control, but also on current economic conditions, foreign exchange rate movements, weather events and other performance variables outside of our control. In measuring our performance against pre-determined performance targets, the Compensation Committee of the Board may make (and over the years has made) adjustments to these targets for items outside of the executive leadership team’s control. In addition to its discretion with respect to the performance-based cash incentives, and equity grants,during those years in which our actual performance resulted in a lower than anticipated level of funding, the Compensation Committee of the Board may from time to time determine that funding should be provided outside of the objective Company performance criteria to fund discretionary bonuses and equity awards to retain or to reward executive officers for their exceptional effortsindividual contribution (measured on an individual,a subjective basis) during those years in which our actual performance resulted in a lower than anticipated level of funding for the variable incentives.. Although the Compensation Committee of the Board has this discretion, it utilizes it infrequently to maintain the integrity of the Company’s compensation structure and philosophy. Because they include material subjective components, our performance-based cash incentives do not meet the requirements for exempt performance-based compensation under Section 162(m) of the Internal Revenue Code. In the future, the Compensation Committee will continue to consider whether to make awards that satisfy the “qualified performance-based compensation” requirements of Section 162(m) in order to maximize tax deductibility of executive compensation, while balancing the interests of our stockholders and the most appropriate methods and approaches for the design and delivery of compensation to our named executive officers.

How We Use Compensation Consultants From time to time, and as needed, the Compensation Committee of the Board retains services of compensation consultants, law firms, and other professionalsprofessional advisors to act as independent advisors to the Compensation Committee.Committee of the Board. In selecting its consultants, the Compensation Committee of the Board takes measures to assureensure that no member of our Board or any named executive officerNamed Executive Officer has any affiliations with such consultants. The Compensation Committee of the Board requires that all off its consultants provide it withan annual certification of their independence. AlthoughIn 2023, the Compensation Committee did not useof the Board utilized the services of compensation advisors in 2015, Compensia, Inc.Meridian Compensation Partners, LLC (Meridian), an executive compensation consulting firm, (Compensia), wasas the Compensation Committee of the Board’s independent advisor. The Compensation Committee of the Board did not use services of other advisors in 2023, but they were available to the Compensation Committee as directed by the Committee chair.

CompensiaMeridian

At least every other year, Compensia providesMeridian will provide the Compensation Committee of the Board with independent compensation advice on various aspects of executive compensation, including: | ·

● | A periodic review of our compensation practices, trends, and philosophy; |

| ● | ·A review of our equity award and cash incentive programs; and

| ·A competitive assessment of our executive compensation levels and pay-for-performance linkage;

|

| ● | ·Assistance in developing recommendations for compensation for our executive officers, including our named executive officers.

| ·An analysis of peer group companies that compete with us and that follow similar compensation models, along with benchmark compensation and benefits data for the peer group;

| |

| ● | A review of our equity award and cash incentive programs; |

| ● | A review of our compensation practices compared to peer group companies and current trends related to executive employment agreements; and |

| ● | Assistance in developing recommendations for compensation for our executive officers, including our Named Executive Officers. |

When asked to provide advice to the Compensation Committee, CompensiaMeridian takes its direction solely from, and provides reports to, the Compensation Committee of the Board, or to members of our in-house human capitalPeople and Culture department at the direction and on behalf of the Compensation Committee.Committee of the Board. All costs of Compensia’sMeridian’s services are paid by the Company at the direction of the Compensation Committee of the Board chair. Although CompensiaMeridian provides recommendations on the structure of our compensation programs, CompensiaMeridian does not determine the amount or form of compensation for any of our named executive officers.Named Executive Officers. From time to time, Compensia Meridian may also providesprovide advice to the Company.Company, with knowledge and consent of the Compensation Committee of the Board.

In those years when CompensiaMeridian is not utilized by the Compensation Committee of ourthe Board, similar compensation analysis is performed by members of our in-house human capitalPeople and Culture department who have special expertise in executive compensation. 23

How We Use Peer Group, Survey, and Benchmark Data Each year, the Compensation Committee of the Board reviews the competitiveness of our compensation program. For 2015,program against our peer group and market benchmarks. The Compensation Committee of the Compensation Committee,Board, with the assistance of our human capital department, identifiedMeridian, identifies a peer group of companies for 2015.companies. For use with 2023 pay decisions, the Compensation Committee of the Board, with the assistance of Meridian, reviewed the Company’s peer group. The peer group for 2015 included: ·Acxiom Corporation

·Constant Contact

·Convergys Corporation

·CSG Systems

| ·DST Systems

·ExlService Holdings

·Fair Isaac

·FTI Consulting, Inc.

| ·Genpact Ltd.

·Sykes Enterprises Incorporated

·Syntel

|

The Compensation Committee selected thisis designed to reflect relevant industries and companies within a reasonable range of TTEC’s Revenue and Operating Income, ideally positioning TTEC near the group’s median. In October 2022, the peer group becausewas reviewed for 2023 pay decisions. As a result of the review, six companies inwere removed due to acquisition and limited data availability, and three companies were added to the peer group are in the sameto include newly recognized business or similar industries, competesegment peers.

This peer group also competes with us for executive talent followand follows similar compensation models and are of a similar size.models. The Compensation Committee reviewsof the Board reviewed the compensation practices of this peer group to effectively design compensation arrangements to attract new executives in our highly competitive, rapidly changing marketsmarket and to confirm proper levels of compensation for our named executive officers.Named Executive Officers. ThisTTEC’s 2023 peer group, approved by the Compensation Committee of the Board in October 2022, includes:

| ● | CSG Systems International, Inc. |

| ● | ExlService Holdings, Inc. |

| ● | ManTech International Corp. |

| ● | TELUS International, Inc. |

Peer group data for executive officers performing the same or similar roles is one factor the Compensation Committee of the Board uses in establishing named executive officerNamed Executive Officer base salaries, (which, in 2015, the Compensation Committee targeted at the 50th percentile of the peer group), and performance-based cash incentive and equity grants, (which, in 2015, the Compensation Committee targeted at the 75th percentile of the peer group), and in otherwise determining the overall mix of equity grants, cash incentives, and base salaries for executive compensation. The Compensation Committee of the Board does not adhere to strict formulas or benchmarking in its review of this peer group data to determine the mix of our executive’s compensation elements. The peer group data is instructive, but it is neither binding nor a dispositive factor in how the Compensation Committee’sCommittee of the Board makes its compensation decisions for the Company. CEO COMPENSATION

Mr. Tuchman, our Chief Executive Officer, beneficially owns more than 65 percent58.7% of the Company. His interest in the Company’s performance, therefore, is very closely and personally aligned with that of our other stockholders. Mr. Tuchman believes that compensation for his services should be in the form of a return on his investment in the Company. At Mr. Tuchman’s request, the Compensation Committee of the Board approved Mr. Tuchman’s base salary to be $1 for 2015.2023. Mr. Tuchman’s salary has remained at this level since 2012. Prior to the Committee’s determination of any incentive awards for 2015,Under Mr. Tuchman advisedTuchman’s employment agreement, he does not participate in our variable compensation plans. Accordingly, the Compensation Committee that heof the Board did not desire to receiveaward any cash incentives or equity grants.grants to Mr. Tuchman. 2015

2023 BASE SALARY COMPENSATION FOR NAMED EXECUTIVE OFFICERS The Compensation Committee of the Board analyzed benchmarks for competitive base salaries using the peer group as described above, targeting the 50th percentile overall as the guide for executive leadership team’sthe Named Executive Officers’ base salary.salaries. Based on these benchmarks, in 2015,effective January 1, 2023, the Compensation Committee of the Board approved a base salary increase for Regina M. PaolilloMr. Semach from $375,000$400,000 to $400,000. $500,000 and Ms. Swanback from $625,000 to $700,000 to reflect updated market data related to their change in duties as a result of their promotions. In addition, the Compensation Committee of the Board approved salary increases for Mr. Bourret during 2023 to acknowledge his additional responsibilities as interim CFO. Ms. McLean received a base salary increase in July of 2023 to align to market benchmarks. The Compensation Committee of the Board determined that the base salaries for other named executive officersNamed Executive Officers were in line with targets, with the exception ofappropriate, except for Mr. Tuchman’s base salary, which has been set at $1 based on Mr. Tuchman’s request. Base salaries for our named executive officersNamed Executive Officers during 2014, 20152022, 2023 and as of this filing for 20162024 have been as follows: Executive | Base Salary | Considerations for Base Salary Determination | | 2016 | 2015 | 2014 | | Kenneth D. Tuchman | $ 1 | $ 1 | $ 1 | As requested by Mr. Tuchman | Martin F. DeGhetto | $400,000 | $400,000 | $400,000 | Based on the role, the scope of responsibilities, and market benchmarks | Charles “Keith” Gallacher | $400,000 | $400,000 | $400,000 | Based on the market benchmarks, and compensation level required to attract Mr. Gallacher to join TeleTech | Judi A. Hand | $350,000 | $350,000 | $350,000 | Based on the role, the size of the business segment that Ms. Hand oversees and performance | Regina M. Paolillo | $400,000 | $400,000 | $375,000 | Based on complexity of the role and market benchmarks |

| Executive | Base Salary | Considerations for Base Salary Determination | | | 2024 | 2023 | 2022 | | | Kenneth D. Tuchman | $1 | $1 | $1 | At Mr. Tuchman’s request, his annual salary is $1. | | Michelle “Shelly” R. Swanback | $700,000 | $700,000 | $625,000 | Based on the role, scope of responsibilities, and market benchmarks. | | Francois Bourret 1 | $400,000 | $400,000 | $255,000 | Based on the role and scope of responsibilities as Interim CFO and Chief Accounting Officer. | | Dustin J. Semach 2 | - | $500,000 | $400,000 | Based on the role, scope of responsibilities, and market benchmarks. | | David J. Seybold | $625,000 | $625,000 | $625,000 | Based on the role, scope of responsibilities, and market benchmarks. | | Margaret B. McLean | $420,000 | $420,000 | $390,000 | Based on the role, scope of responsibilities, and market benchmarks. |

| 1. | Mr. Bourret was appointed Interim Chief Financial Officer of the Company on March 17, 2023. |

| 2. | Mr. Semach resigned from his position as Chief Financial Officer of the Company and exited the Company effective April 14, 2023. |

24

Table of Contents

2015 PERFORMANCE-BASED CASH INCENTIVE AWARDAWARDS

Performance-Based Cash Incentives Funding Criteria The Compensation Committee of the Board resets the variable, annual cash incentive award funding targets at the beginning of each year. In 2015, For 2023, the Compensation Committee of the Board selected revenue and operating incomePre-Bonus Adjusted Operating Income targets in setting our variable incentive funding targets because these targets arethis target was consistent with the Company’s long-term growth objectives and alignaligned the interests of management with the interests of our stockholders. As part of its compensation philosophy, the Compensation Committee setof the Board sets reasonable stretch targets that are difficult to achieve, but which it believes wereare achievable. For purposes of cash incentives paid in 2015 for 2014 performance, the Compensation Committee approved the award of $1.09 million to the then named executive officers, based on the revenue and operating income levels achieved in 2014 against the annual targets, as shown in the table below. Achievement at the 100 percent of annual revenue and operating income targets in 2014 would have resulted in the funding of the cash incentives for the then named executive officers at $3.15 million. The failure to achieve minimum annual revenue and operating income targets in 2014 would have resulted in zero funding of the cash incentives in 2015.

The equitable adjustments to the 2014 actual results were determined by the Compensation Committee by factoring in the strong performance of the overall business adjusted for the considerable challenges in the Customer Technology Services (CTS) business segment which significantly missed its 2014 operating income targets due to execution and market factors. The Committee wished to balance the Company’s commitment to use objective and pre-determined funding criteria with the positive momentum in the remaining business segments of the Company and the importance of rewarding and retaining high performing, critical talent while maintaining operating income performance consistent with the Company’s guidance.

The adjusted 2014 revenue and operating income results measured against the targets were as follows:

Performance-Based Cash

Incentive Funding Metrics

| 2014 Target

| 2014 Performance

| Adjusted 2014

Performance

| Total 2015 Performance-Based Cash

Award Funding for 2014 Performance

| Annual Revenue

| $1.24 – $1.26 billion

| $ 1.24 billion

| $ 1.24 billion

| | Operating Income

| $108 – $131 million

| $96.4 million

| $110.2 million

| $9.7 million

|

With respect to cash incentives paid in 2016 for 2015 performance, the Compensation Committee approved the award of $0.87 million to named executive officers, based on their performance against 2015 revenue and operating income targets, as adjusted. Achievement at the 100 percent of annual revenue and operating income targets in 2015 would have resulted in the funding of the cash incentives for named executive officers at $3.1 million. The failure to achieve minimum annual revenue and operating income targets in 2015 would have resulted in zero funding of the cash incentives in 2016.

The only adjustment that the Compensation Committee made to the 2015 results of operation for purposes of determining 2015 cash incentive awards were due to foreign exchange fluctuations, which are not reasonably capable of being hedged. The Compensation Committee determined that such adjustments were appropriate because these events were outside of direct control of the Company and the management team.

The adjusted 2015 revenue and operating income results measured against the targets as follows:

Performance-Based Cash

Incentive Funding Metrics

| 2015 Target

| 2015 Performance

| Adjusted 2015

Performance

| Total 2016 Performance-Based Cash

Award Funding for 2015 Performance

| Annual Revenue

| $1.325 billion

| $1.29 billion

| $1.351 billion

| | Operating Income

| $111 million

| $90.2 million

| $117.6 million

| $12.76 million

|

Individual Performance Targets and Awards for Performance-Based Cash Incentives If and when any cash incentives are available, based on the overall performance of the Company, how the funds are allocated to each named executive officerNamed Executive Officer is determined by the Compensation Committee of the Board, at its discretion, based on the recommendation of the Chief Executive Officer, and based on the Compensation Committee’sCommittee of the Board’s view of the executive’s contribution to the execution of the Company’s strategic priorities as set forth below: Strategic Priorities | Performance Objectives | ·Deliver profitable top-line growth

·Continuously innovate customer experience

·DriveExecute against our go to market adoption of emerging solutions

·Execute strategicstrategy.

| Sign new business and accretive acquisitions·Enhance the TeleTech client and employee experiences

grow revenue. | | Maintain our market share in our key markets, with our key clients, in our offerings. | ·New business signed and revenue growth

·Improved Operating IncomeImprove year-over-year operating income and free cash flow

·Clientflow.

| | Deliver innovative solutions in emerging digital CX technology and services. | Increase client satisfaction and retention·Employeeretention.

| | Optimize how we do business (people, technology, and facilities). | Increase employee satisfaction and retention·Overhead efficiency

retention. | | Attract and retain the best CX talent. | Improve overhead efficiency. |

25

Table of Contents

ThereUnder TTEC’s pay-for-performance philosophy there is no formulaic tiea clear correlation between the Company’s financial results of operations and the amount of the cash incentives payable to individual executives under the variable cash incentive plan, once the minimum target levels of financial performance necessary to fund the plan, as determined by the Compensation Committee of the Board, are achieved by the Company. The Compensation Committee of the Board has discretion, however, to increase cash incentives based on special circumstances and performance milestones that may not have translated into financial performance of a business segment or a function in a given year if they nonetheless positioned the Company for material gains in the future. The Compensation Committee of the Board also has discretion to reduce such incentives if an executive failed to meet specific goals.

Our cash incentives do not provide for the adjustment or recovery of amounts paid to a named executive officerNamed Executive Officer if the results in a previous year are subsequently restated or adjusted in a manner that would have originally resulted in the payment of a smaller award.different amount. We maintain an incentive recoupment (clawback) policy which was updated in 2023 to comply with NASDAQ listing standards implementing Exchange Act Rule 10D-1. Under this policy, if we are required to undergo an accounting restatement as the result of material noncompliance with financial reporting requirement under the securities laws, the Compensation Committee of the Board must, subject to limited exceptions, seek to recoup compensation received by a covered executive (including the Named Executive Officers) in excess of the amount the covered executive would have received based on the restated results. We may also pursue other remedies under applicable law, including disciplinary actions up to and including termination of employment, in addition to recouping any excess incentive compensation. 2023 Cash Award Funding and Pre-Bonus Adjusted Operating Income Results for 2022 Performance For purposes of determining the 2023 cash incentive funding for 2022 performance, the Compensation Committee of the Board adjusted 2022 results of operations due to foreign exchange fluctuations, which account for variance between foreign exchange (FX) rates used to set 2022 targets and the actual 2022 FX rates. The Compensation Committee of the Board determined that such adjustment was appropriate because these events were outside of direct control of the Company and the management team. The 2022 Pre-Bonus Adjusted Operating Income results measured against the targets were as follows: Performance-Based Cash

Incentive Funding Metrics | 2022 Target | 2022 Performance | 2022 Performance

– Adjusted for FX | Total Performance-Based Cash Award

Funding for 2022 Performance | | Pre-Bonus Adjusted Operating Income1 | $295.98 million | $197.8 million | $193.2 million | $7.77 million |

| 1. | TTEC presents company performance metrics on a non-GAAP basis to more accurately convey the performance of the business, which adjusts for non-operating items including, but not limited to, asset impairment, restructuring charges, cybersecurity incident-related costs, changes in acquisition contingent considerations, and one-time non-recurring items. |

Cash Incentives Paid in 20152023 For 2022 Performance In 2015,While the 2022 cash incentive plan provided a minimal level of funding with respect to cash incentives that would have been paid in the first quarter of 2023 related to 2022 performance, the Compensation Committee of the Board elected not to pay bonuses to the then NEOs based on performance results against the 2022 Pre-Bonus Adjusted Operating Income targets.

As Mr. Bourret was not a Named Executive Officer in 2022, he was eligible for and did receive a cash incentive. Named Executive

Officer | Target Cash

Incentives % Base

Salary | Actual Cash

Incentives Paid

in 2023 for 2022

Performance | Cash Incentives as

a % of Target | Basis for Cash Incentive Award | | Kenneth D. Tuchman | 0% 1 | – | – | Under Mr. Tuchman’s employment agreement, he does not participate in this program. | | Michelle “Shelly” R. Swanback | Up to 100% | -- | 0% | -- | | Francois Bourret | Up to 40% | $54,000 | 58% | Based on Mr. Bourret’s achievement of 2022 performance goals. | | Dustin J. Semach | Up to 100% | -- | 0% | -- | | David J. Seybold | -- | -- | -- | Mr. Seybold was hired in November 2022 and was not eligible to participate in the incentive plan for 2022 performance. | | Margaret B. McLean | Up to 75% | -- | 0% | -- |

| 1. | As noted elsewhere in these proxy materials, at Mr. Tuchman’s request, he does not participate in this program. |

2024 Cash Award Funding and Pre-Bonus Adjusted Operating Income Results for 2023 Performance For purposes of determining the 2024 cash incentive funding for 2023 performance, the Compensation Committee of the Board adjusted 2023 results of operations due to foreign exchange fluctuations, which account for variance between FX rates used to set 2023 targets and the actual 2023 FX rates. The Compensation Committee of the Board determined that such adjustments were appropriate because these events were outside of direct control of the Company and the management team. Based on each segment’s performance against their annual Pre-Bonus Adjusted Operating Income targets, the Compensation Committee of the Board approved only the minimum funding level of $8 million. The 2023 Pre-Bonus Adjusted Operating Income results measured against the targets were as follows: Performance-Based Cash

Incentive Funding Metrics | 2023 Target | 2023 Performance | 2023 Performance

– Adjusted for FX | Total Performance-Based Cash Award

Funding for 2023 Performance | | Pre-Bonus Adjusted Operating Income1 | $249.6 million | $154.7 million | $165.1 million | $8 million | | | | | |

| 1. | TTEC presents company performance metrics on a non-GAAP basis to more accurately convey the performance of the business, which adjusts for non-operating items including, but not limited to, asset impairment, restructuring charges, cybersecurity incident-related costs, changes in acquisition contingent considerations, and one-time non-recurring items. |

Cash Incentives Paid in 2024 For 2023 Performance In 2024, based on 2023 company financial performance, the Compensation Committee of the Board awarded $697,703 in cash incentives to the named executive officersNamed Executive Officers for 20142023 performance as follows: Named Executive

Officer | Target Cash

Incentives % Base

Salary | Cash Incentives Paid in

2015 for 2014 Performance | Basis for Cash Incentive Award | | Target | Actual | | Kenneth D. Tuchman | 0%1 | – | N/A | Martin F. DeGhetto | 200% | $370,000 | Based on Mr. DeGhetto’s contribution to the revenue growth and operating income improvements resulting from the Customer Management Services business segment’s 2014 performance. | Charles “Keith” Gallacher | 200% | $370,000 | Based on Mr. Gallacher’s contribution to TeleTech’s performance through sales execution and increased bookings. | Judi A. Hand | 200% | $325,000 | Based on Ms. Hand’s contribution to TeleTech’s performance through the Customer Growth Services segment’s 2014 performance. | Regina M. Paolillo | 200% | $392,066 | Based on Ms. Paolillo’s significant contribution to strategy execution and overhead efficiencies. |

| Named Executive Officer | Target Cash

Incentives

% Base Salary | Actual Cash Incentives

Paid in 2024 for

2023 Performance | Actual Cash

Incentive as % of

Base Salary | Basis for Cash Incentive Award | | Kenneth D. Tuchman | 0% 1 | – | – | Under Mr. Tuchman’s employment agreement, he does not participate in this program. | | Michelle “Shelly” R. Swanback | Up to 100% | $175,000 | 25% | Aligned with the minimum funding to recognize Ms. Swanback’s achievement of performance milestones. | | Francois Bourret | Up to 40% | $32,453 | 25% | Aligned with the minimum funding to recognize Mr. Bourret’s achievement of performance milestones. | | Dustin J. Semach 2 | – | – | – | – | | David J. Seybold | Up to 100% | $156,250 | 25% | Aligned with the minimum funding to recognize Mr. Seybold’s achievement of performance milestones. | | Margaret B. McLean | Up to 85% | $334,000 3 | 100% | To recognize specific one-time contributions to enterprise risk mitigation in 2023. |

| 1. | As noted elsewhere in these proxy materials, at Mr. Tuchman’s request, he does not participate in this program. |

| 2. | As Mr. Semach exited the Company effective April 14, 2023, he was not eligible for an award. |

| 3. | Includes $90,000 aligned to minimum funding and $244,000 as a retention bonus in recognition of additional contributions. |

1As noted elsewhere in these Proxy materials, Mr. Tuchman has elected to forego participation in the Company’s discretionary cash incentive awards program.2023 Equity Grants

Annual Grants Cash Incentives Paid in 2016 With Respect to 2015 Performance

In February 2016, the Compensation Committee awarded cash incentives to the named executive officers for 2015 performance as follows:

Named Executive

Officer | Target Cash

Incentives% Base

Salary | Cash Incentives Paid in

2016 for 2015 Performance | Basis for Cash Incentive Award | | Target | Actual | | Kenneth D. Tuchman | 0%1 | – | N/A | Martin F. DeGhetto | 200% | $221,500 | Based on Mr. DeGhetto’s contribution to TeleTech’s overall performance in 2015. The year over year decrease is due to Customer Management Services segment not meeting its 2015 revenue and operating income targets. | Charles “Keith” Gallacher | 200% | $100,000 | Based on Mr. Gallacher’s contribution to TeleTech’s performance in 2015. The year over year decrease is due to the fact that while revenue bookings grew year over year, they did not meet 2015 targets as set by the Company. | Judi A. Hand | 200% | $325,000 | Based on Ms. Hand’s contribution to TeleTech performance in 2015. The year over year increase is due to significant revenue growth in the Customer Growth Services segment in 2015. | Regina M. Paolillo | 200% | $221,500 | Based on Ms. Paolillo’s significant contribution to TeleTech strategy execution. The year over year decrease is due to the fact that the Company did not meet its 2015 financial targets. |

1 As noted elsewhere in these Proxy materials, Mr. Tuchman has elected to forego participation in the Company’s discretionary cash incentive awards program.

26

Table of Contents

2015 Equity Grants

In 2015, the Compensation Committee considered whether equity awards were warranted in light of the Company’s performance, peer company benchmarks and each individual named executive officer’s performance. Based on this review, the Compensation Committee determined to make2022 company performance, there was a minimum level of equity funding available in 2023 for annual restricted stock unit (RSU) grantsequity grants. The Compensation Committee of the Board determined that our then Named Executive Officers would not be eligible for an annual RSU grant in 2023 related to our named executive officers. Theperformance year 2022.

As Mr. Bourret was not a Named Executive Officer in 2022, he was eligible for and did receive an annual equity grant. Generally, the primary characteristics of theTTEC annual RSUs being granted were:to Executives are: | ·

● | Annual RSU grants vest in four-year increments with 25 percent25% of the award vesting on each of the award anniversary dates.· anniversary.

|

| ● | Executive officerofficers must remainbe employed by the Company through the vesting date for each portion of the grant to vest.· The awards

|

| ● | Awards are structured to have a strong retention value and align executives’ interests to stockholders’ interestinterests over a longer term. |

| ● | · RSUs provide a long-term incentive to balance shorter-termshort-term incentives provided by cash awards and base salaries.

·

|

Named Executive

Officer | 2023 FMV RSU

Annual Grant | 2023 RSU Shares Granted | Considerations for 2023 Determination | | Kenneth D. Tuchman 1 | – | – | Under Mr. Tuchman’s employment agreement, he does not participate in this program. | | Michelle “Shelly” R. Swanback | -- | -- | | | Francois Bourret | $34,985 | 953 | Based on Mr. Bourret’s 2022 performance contributions. | | Dustin J. Semach | – | -- | Mr. Semach was ineligible as he left his position as Chief Financial Officer of the Company effective April 2023. | | David J. Seybold | -- | -- | Mr. Seybold was hired in November 2022 and was not eligible for this annual RSU grant based on 2022 performance. | | Margaret B. McLean | -- | -- | |

| 1. | As noted elsewhere in these Proxy materials, at Mr. Tuchman’s request, he does not participate in this program. |

2023 Retention Grants In 2015,2023, in addition to our annual grant program, the Compensation Committee madeof the following RSU grantsBoard approved a special one-time retention grant to retain and motivate high-potential business-critical employees who were needed to support the business over the next 12 to 24 months. Both Mr. DeGhetto, Mr. Gallacher, Ms. Hand,Bourret and Ms. Paolillo. These grants vestMcLean received a grant under this program with a grant date fair value of $34,985 and $59,984, respectively. 2023 Promotional Grants In connection with her promotion to President, TTEC Holdings, Inc., the Compensation Committee of the Board agreed to provide Ms. Swanback, in March 2023, a one-time $2 million RSU equity grant, vesting in equal installments over a five-year period, and a $2 million performance-based equity grant, subject to a 3-year cliff vesting period. Ms. Swanback may earn between 0% to 200% of the performance-based equity award based on the achievement of the established financial targets for 2025. In connection with Mr. Bourret’s appointment to interim Chief Financial Officer, the Compensation Committee of the Board agreed to provide him a one-time RSU grant of $400,000 vesting in four equal installments onover a four-year period. Long-Term Incentive Plans (LTIP) Our executive compensation program includes a three-year long-term incentive program (the “LTIP”). The LTIP program provides select senior executives with an incentive opportunity in addition to TTEC’s regular annual RSU equity grant. Each performance-based equity award is aligned to company financial targets with a three-year measurement period. Under the award, each anniversary dateparticipant may earn between 0% to 200% of the grant through 2019, subjectaward based on the achievement of the established financial targets.

2021 Long-Term Incentive Plan (LTIP) In March of 2021, the Compensation Committee of the Board approved performance metrics of Revenue and Adjusted Operating Income for the 2021 LTIP award. Each performance metric is weighted 50%. The 2021 LTIP has one measurement period – ending as of the end of fiscal year 2023 (three-year measurement period). Each senior executive eligible to continued employmentparticipate in the 2021 LTIP may earn between 0% to 200% of the award target, based on the Revenue and Adjusted Operating Income performance of the Company during the measurement period. Under the 2021 LTIP, the performance criteria, at max target, are aligned with an average 10% annual growth rate in the Company.Company’s Revenue and 10% annual growth rate in Adjusted Operating Income, compared to 2020 financial results, over the three-year measurement period (2021-2023). | Revenue Targets | Adjusted Operating Income1 Targets | Award Opportunity | | (amounts in millions) | (amounts in millions) | | 2023 | CAGR | 2023 | CAGR | | $2,256.21 | 5.0% | $244.95 | 5.0% | Threshold – 50% | | $2,354.29 | 6.5% | $255.60 | 6.5% | Target – 100% | | $2,455.18 | 8.0% | $266.56 | 8.0% | Above Target – 150% | | $2,594.12 | 10.0% | $281.64 | 10.0% | Max Target – 200% |

| Named Executive Officer

1. | FMV 2015

RSU GrantTTEC presents company performance metrics on a non-GAAP basis to more accurately convey the performance of the business, which adjusts for non-operating items including, but not limited to, asset impairment, restructuring charges, cybersecurity incident-related costs, changes in acquisition contingent considerations, and one-time non-recurring items.

|

| Named Executive Officer | 2021 FMV Performance-Based Equity Grant | 2021 Target Performance- Based Equity

Grant (in shares) 1 | | Kenneth D. Tuchman 2 | - | - | | Michelle “Shelly” R. Swanback 3 | - | - | | Francois Bourret 4 | - | - | | Dustin J. Semach 5 | - | - | | David J. Seybold 6 | - | - | | Margaret B. McLean | $174,996 | 2,069 |

| 1. | 2015 RSU Grant

| Considerations for 2015 Determination

| Kenneth D. Tuchman

| $0

| 0 Shares

| Mr. Tuchman requested that the Compensation Committee provide no equity grant for him in 2015.

| Martin F. DeGhetto

| $ 750,008

| 27,696 Shares

| Mr. DeGhetto’s equity grant made in 2015, for 2014 performance, was were calculated based on the overallfair market value of the grant divided by the closing stock price of our common stock on the grant date.

|

| 2. | As noted elsewhere in these proxy materials, at Mr. Tuchman’s request, he does not participate in this program. |

| 3. | Due to Ms. Swanback’s hire date in May 2022, she was not eligible to participate in the 2021 long-term incentive plan. |

| 4. | Mr. Bourret was not eligible to participate in this 2021 LTIP program. |

| 5. | Due to Mr. Semach’s termination in April 2023, his award was cancelled before the end of the measurement period. |

| 6. | Due to Mr. Seybold’s hire date in November 2022, he was not eligible to participate in the 2021 long-term incentive plan. |

With respect to the 2023 measurement period of the 2021 LTIP, senior executives earned 75% of their target award. In determining the Company’s 2023 achievement under the LTIP, the Compensation Committee of the Board considered adjustments related to foreign exchange fluctuations (the variance between foreign exchange rate estimates used to set 2023 performance targets and the actual 2023 foreign exchange rates). The Compensation Committee of the Board determined that such adjustments were appropriate because these events were outside of direct control of the Company and the management team and could not have been reasonably anticipated by them. Based on the Company’s 2023 Revenue and the terms of the 2021 LTIP, the Revenue component (weighted 50%) was earned at 150% of target, while no portion of the Adjusted Operating Income component of the award was earned. 2023 Long-Term Incentive Plan (LTIP) In March of 2023, the Compensation Committee of the Board approved performance metrics of Revenue and Adjusted earnings before interest, taxes, depreciation and amortization1 (Adjusted EBITDA) for the 2023 LTIP award. Each performance metric is weighted 50%. The 2023 LTIP has one measurement period – ending as of the end of fiscal year 2025 (three-year measurement period). Each senior executive eligible to participate in the 2023 LTIP may earn between 0% to 200% of the award target, based on achievement to the established Revenue and Adjusted EBITDA targets for fiscal year 2025. Under the 2023 LTIP, the performance criteria, at max target, are aligned with an average 8.6% annual growth rate in the Company’s Revenue and 10.3% annual growth rate in Adjusted EBITDA, compared to 2022 financial results, over the three-year measurement period (2023-2025). | Revenue Targets | Adjusted EBITDA Targets1 | Award Opportunity | | (amounts in millions) | (amounts in millions) | | 2025 | CAGR | 2025 | CAGR | | $2,880 | 5.6% | $393 | 6.4% | Threshold – 50% | | $2,957 | 6.6% | $408 | 7.7% | Target – 100% | | $3,046 | 7.6% | $423 | 9.0% | Above Target – 150% | | $3,128 | 8.6% | $438 | 10.3% | Max Target – 200% |

| 1. | TTEC presents company results.performance metrics on a non-GAAP basis to more accurately convey the performance of the business, which adjusts for non-operating items including, but not limited to, asset impairment, restructuring charges, cybersecurity incident-related costs, changes in acquisition contingent considerations, and one-time non-recurring items. |

| Named Executive Officer | 2023 FMV Performance-Based Equity

Grant | 2023 Target Performance- Based Equity Grant

(in shares) 1 | | Kenneth D. Tuchman 2 | - | - | | Michelle “Shelly” R. Swanback | $3,249,993 3 | 89,261 | | Francois Bourret 4 | - | - | | Dustin J. Semach 5 | - | - | | David J. Seybold | $312,507 | 8,583 | | Margaret B. McLean | $210,013 | 5,768 |

| Charles “Keith” Gallacher

1. | $1,132,514

| 43,959 Shares

| Mr. Gallacher received two equity grants in 2015, both with respect to his 2014 performance. He received 16,263 shares in early 2015 based on strong progress made in revenue bookings in 2014. He also received an annual grant of 27,696 shares for 2014 performance were calculated based on the overall company results.

| Judi A. Hand

| $ 750,008

| 27,696 Shares

| Ms. Hand’s equityfair market value of the grant made in 2015, for 2014 performance, was baseddivided by the closing stock price of our common stock on the overall company results.

grant date. | | Regina M. Paolillo

2. | $ 750,008

As noted elsewhere in these proxy materials, at Mr. Tuchman’s request, he does not participate in this program. | | 3. | 27,696 Shares

Includes annual PRSU grant of $1,249,992 and one-time promotional PRSU grant of $2,001,000. | | 4. | Ms. Paolillo’s equity grant madeMr. Bourret was not eligible to participate in 2015, for 2014 performance, was based on the overall company results.

this 2023 LTIP program. | | 5. | Mr. Semach did not receive an award under this 2023 LTIP program. |

272022 Value Creation Program

Table of Contents

Employment AgreementsAs previously disclosed in 2023 Proxy Materials, in 2022, the Compensation Committee of the Board approved a one-time equity incentive program, known as a value creation program or VCP, that was designed to create an opportunity for a few senior executives, including some of the NEOs, to receive equity grants aligned to stretch revenue and adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA) for the Company, and measured based on the Company’s performance during 2022 through 2025 period. Executives were selected to participate in the program based on their direct ability to impact the performance of the business during the measurement period.

From time to time, we have entered into employment agreements with senior executive officers, including three of our named executive officers: Messrs. Tuchman, Gallacher and Ms. Paolillo.

EMPLOYMENT AGREEMENTS As a matter of policy, the Company does not usually enter into employment agreements, except with members of the executive leadership team, in circumstancecircumstances when it is required to do so by law, in connection with acquisitions, or in special circumstances when managementthe Company believes that such agreements are necessary to attract an executive or retain an executive in light ofhighly competitive market conditions. The Compensation Committee of the Board reviews, but is not required to approve, employment agreements with senior executive officers, except agreements with our Chief Executive Officer, andthe Chief Financial Officer, and the direct reports of the Chief Executive Officer. The primary compensation terms of our employment agreementsarrangement with those named executive officers who have the agreementsour Named Executive Officers are summarized below. Tuchman Agreement | Tuchman Agreement

· TeleTech

● | TTEC entered into an employment agreement with Mr. Tuchman in 2001. ·

| | ● | Base Salary and Incentives.Pursuant to the terms of the agreement, Mr. Tuchman is entitled to base salary, annual cash, and equity incentives. But beginning in 2012, Mr. Tuchman requested that the Compensation Committee limit his base compensation to $1 and awardedaward him no annual cash or equity incentives.·

| | ● | Benefits. Mr. Tuchman and members of his family are entitled to participate in all TeleTechTTEC employee benefits at the Company’s expense.·

| | ● | Life Insurance.Insurance. The Company agreed to provide Mr. Tuchman with $4,000,000a $4 million term life insurance policy, premiums fully paid by the company.Company. The policy isand its proceeds are owned by Mr. Tuchman and may continue post termination of employment, subject to Mr. Tuchman paying all the premiums.· Severance.

| | ● | Severance. Subject to customary releases, Mr. Tuchman is entitled to severance in the amount of 24 months of base pay, if he is terminated without cause or terminates his employment for “good reason”.· reason.”

| | ● | Change in Control Provisions.Provisions. The employment agreement provides forincludes change in control provisions that result in accelerated vesting of all unvested equity awarded to Mr. Tuchman, subject to certain conditions that have been superseded by change in control provisions of specific equity grant documents (see, “Executive“Executive Compensation Tables - Potential Payments upon Termination or Change in Control” section of the Proxy Statement).· Non-Disparagement.

| | ● | Non-Disparagement. The agreement provides that on separation of affiliation, whatever the reason, TeleTechTTEC will refrain from any comments regarding Mr. Tuchman and his affiliation with TeleTech.TTEC. A breach of this provision provides for a $200,000 liquidated damages payment. Mr. Tuchman is similarly precluded from making disparaging comments about the Company. |

Swanback Agreement | ● | Paolillo Agreement

· TeleTechTTEC entered into an employment agreement with Ms. PaolilloSwanback in 2011.

· May 2022, when she joined the Company as chief executive officer for the TTEC Engage business segment, and thereafter amended that agreement effective January 2023, to reflect Ms. Swanback’s additional responsibilities as President TTEC Holdings, Inc.